Trust – and Avoiding the Bernie Madoffs

I know, Bernie is in jail. But there are others just like him out there, so how do you know you can trust the advisor you select to manage your investment portfolio? Trust is not easy to quantify, but it is crucial in all financial relationships. Sometimes, you just know in your gut whether or not someone is trustworthy. There are some concrete ways to bolster your intuition so you can feel like you’re putting your finances in the right hands.

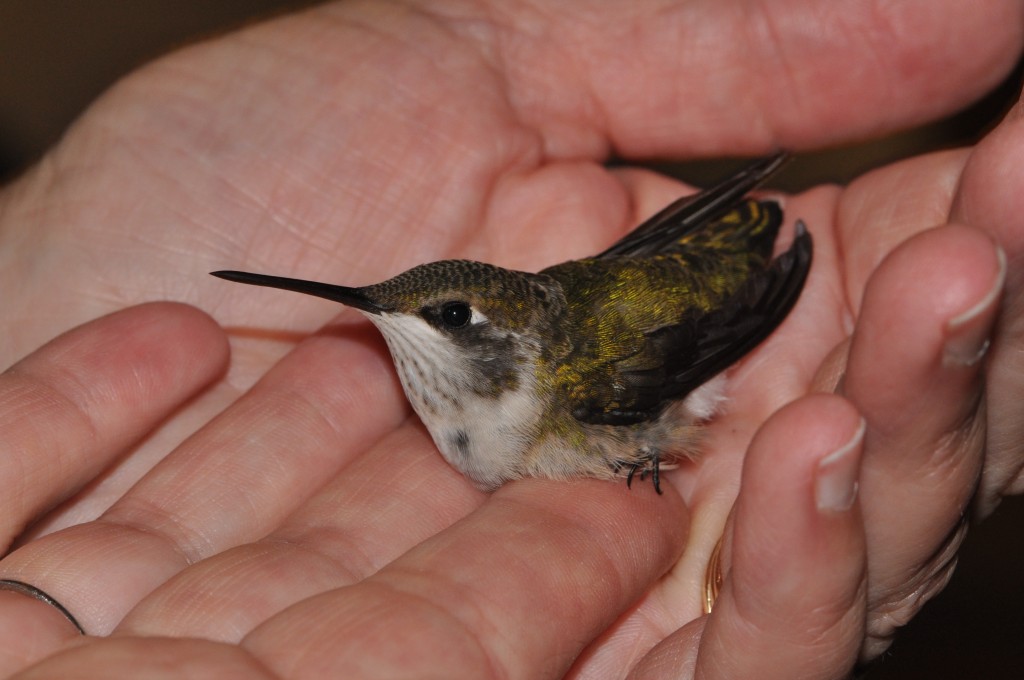

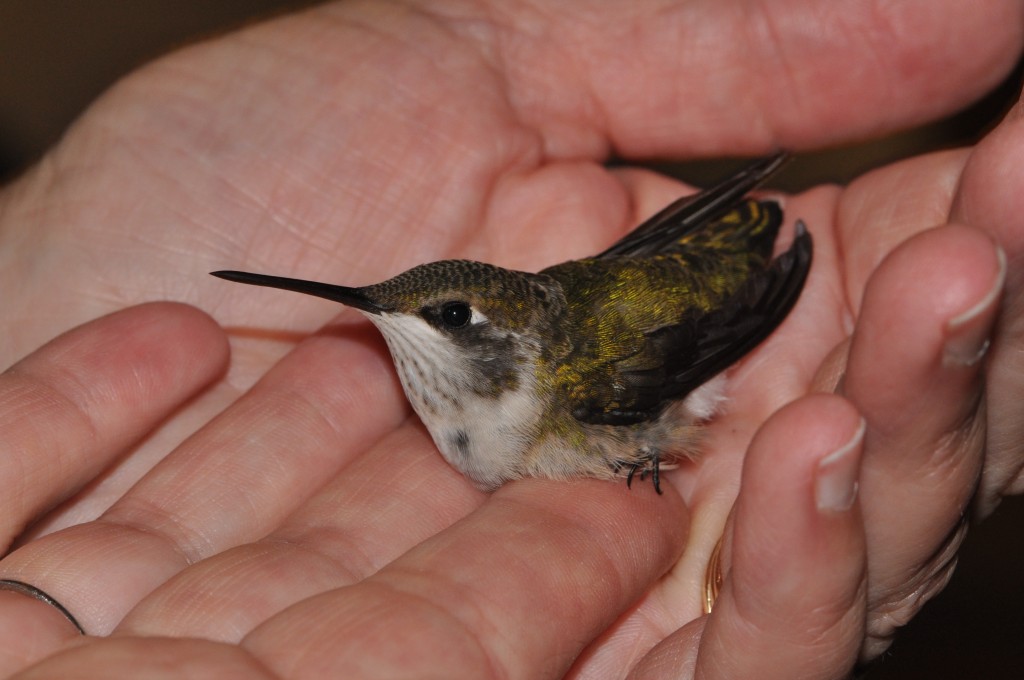

Trust – when you know you’re in good hands. (Photo credit Mary Moore.)

Below are some important considerations, many of which were inspired by the book Lost and Found by Geneen Roth. Roth was one of the millionaires who entrusted Bernie Madoff with everything she had.

Diversification – Roth admits she knew the importance of “not putting all you eggs in one basket” before she handed all her assets to Madoff. She just decided his brilliance outweighed the value of evergreen investment principles. Some clients like to find diversity in hiring a variety of advisors, others choose a variety of investment strategies to achieve the same end. I believe in passive investing which utilizes empirical diversification of asset classes. Nothing else has been proven to stabilize a portfolio through up and down markets, which is the ultimate aim. Without that stabilization, down markets (which happen with regularity) can be difficult to bounce back from. Other diversification tactics may make you feel better – which can be important – but from an academic perspective they don’t ensure less volatile results. Ultimately your chosen method of diversification will depend upon your sophistication as an investor and your ability to trust your advisor.

Performance – Roth often wondered how Madoff had such consistently high returns; it seemed it couldn’t be explained. Now we know why. The only way to get high returns is to take more risk. Anyone who suggests otherwise is lying. Period. Hedge funds like Madoff’s are riskier, and you can’t always get your money out when you need it, if you’re willing to take that additional risk, you might get a higher than 6-9% annual return. Might. Ask yourself if it’s worth it.

Due diligence – Would you marry someone you hardly knew? (Your answer better be “Of course not!”) Then you already know that hard work and checking of sources is mandatory, regardless of the size of the firm you are considering. Just because an establishment is large we cannot to deduce that all those other investors have decided to trust him, so he must be ok. Madoff was one of the largest market makers on Wall Street when his ponzi scheme came crashing down around him. Popular advisors aren’t always the best ones.

Certifications – The advisor you hire should have demonstrable skills as certified by a credible institution. I chose to become a CFP® (Certified Financial Planner™) because that credential requires work experience, a rigorous board exam, ethical practices, ongoing education, and it represented the body of knowledge I perceived would be most relevant to my own family’s finances. The value of my certification to my clients is measurable as CFP®s strive to take care of all aspects of your financial life. Be sure to take note of the letters behind an advisor’s name, and ask about the qualifications each one represents.

Oversight – Solid independent auditing firms can be a great source of confidence for you as a client as long as they are large enough to have a reputation to uphold. In the case of Madoff, he hired a small auditing firm and apparently everyone was a little too friendly because the secret sauce to Madoff’s magic recipe was nothing more than lies. Whenever a firm I worked for got audited (we always did well, FYI), it was tense. Not because we were trying to hide anything, or because we lacked trust in the systems we had established to protect our clients. It was stressful because these people were hired to go through your records with a fine tooth comb, and that kind of scrutiny requires some distance between the two parties. Go ahead and ask your advisor about the measures in place to make sure they do what they say they do.

Fiduciary Duty– The industry throws this phrase around and it basically means “acting in the client’s best interest.” In finance, there can be competing interests, namely yours and your advisor’s. If the advisor is motivated to recommend things that fill his pockets and more than yours, he is likely to act in his own interest. But in the case of firms acting as fiduciaries, they place YOUR needs first. Make sure your advisor is willing to be called your fiduciary, and in the wealth management space, consider advisors who have elected to be certified through CEFEX.org

For more information on choosing an advisor, visit this Directions for Women article on questions you should ask potential candidates. Or to find a CFP® in your area, visit the CFP® Board’s search tool. As a financial coach, one of my goals is to help you find the right advisor for your portfolio, so email me if you want to engage me in that process: Candice (at) HerDollars.com.

1 Comment