So You Married Your Financial Opposite – Now What?

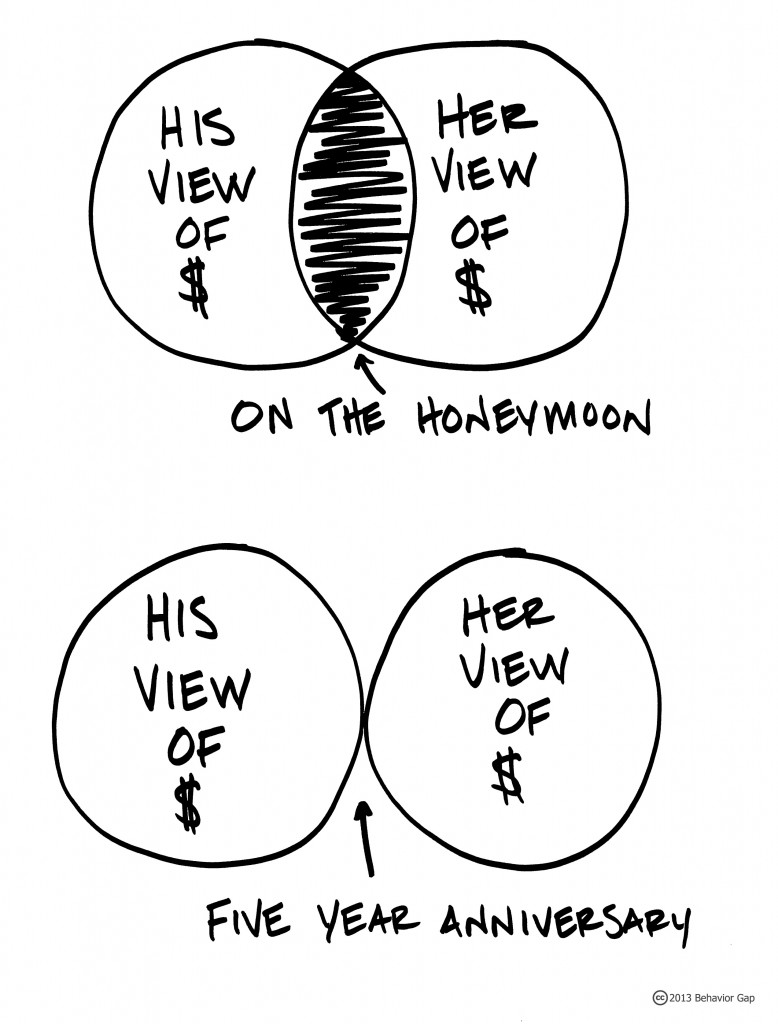

I recently found this sketch by Carl Richards of Behavior Gap. He introduces himself as “the world’s best (in a category of one) financial illustrator with a Sharpie.”

I hate the fact that he’s right. But when you talk to couples who have been in it for the long marital haul, they often say it is more important to learn to work through differences than it is to be the same.

Well, in the financial arena, that’s good news. It means we are allowed to disagree. And we *definitely * disagree. Olivia Mellan, an expert in financial counseling for couples, says “If (financial) opposites don’t attract right off the bat – and they usually do — then they’ll create each other eventually”. This means that even when two voracious spenders get married, they will eventually disagree about finances as one spouse changes to take the opposite point of view. This person will begin delaying gratification or creating budgets, because – as Mellan says – “SOMEONE has to worry about the money.”

So the dyad of marriage requires a fine balance that can only be attained when each spouse takes a position on the opposite side of the proverbial financial fence. Simply recognizing this can take a lot of pressure off the marriage, as some people begin to wonder if they married the “wrong one.” After all, the original intention behind marriage was “iron sharpening iron,” not “irons living happily ever after in their relative dullness.”

Unity between you is not as important as harmony. You won’t see things the same way, but you can agree to work out those differences together. As with many marriage issues – the “good cop/bad cop” method of child discipline comes to mind – the reason for balance between you is evident. Someone has to be reasonable, and someone has to be fun. Between the two of you, there is balance. It may not come easily, but be encouraged because you two are not alone in your differences.

To begin working together, here are some discussion starters from Olivia Mellan. She’s addressing newlyweds and engaged couples, but it is never too late to begin this conversation. My personal favorite in terms of effectiveness is Number 5: Share your money history and your financial phobias.

Take turns sharing your childhood memories about money, advises Mellan. How did your parents save it, spend it and talk about it? What specific money messages did you get from family, friends, even religious teachings and how might they be affecting you today? Share your hopes and dreams as well as your fears and hurts over money. Talk about your worst financial nightmare. If you identify problems, you can begin to work out solutions.

Mellan is a fan of talking about our money issues and moving toward “depolarization.” As this article “5 Ways Couples Can End Money Spats” explains:

If each partner is aware of the other’s spending style and the lines of communication remain open, each person will have a better idea of where the other one is coming from. “Walk half a mile in your partner’s moccasins,” says Mellan. If you stop to think how your partner feels about the situation, she adds, you and your spouse will be less polarized.

So, if you married your financial opposite, take heart. You are not alone, your situation might actually be better for you than the alternative, and there are ways to move forward by tackling your finances as a team. But first, you need to start talking.

Would you like to take the quiz to determine your Money Personality? Click here.

Need some support as you begin this conversation? Let’s talk. Apply for a complimentary coaching session so we can get you started.